Mortgage refinancing allows homeowners to adjust their loans for better financial stability. It allows you to replace your existing mortgage with a new one that offers improved terms. When you understand how refinancing works and why homeowners choose it, you can make informed decisions and plan for long-term financial benefits with greater confidence.

What Is Mortgage Refinancing?

Mortgage refinancing is the process of replacing your current home loan with a new mortgage that offers different terms. This new loan pays off your existing balance and creates a fresh repayment schedule. Refinancing helps homeowners improve their monthly payments, secure lower interest rates, or change the length of the loan based on financial goals.

How Refinancing Changes Your Existing Loan

Refinancing your mortgage replaces your current loan with new terms. This can include a lower rate, a shorter or longer loan period, or a different payment structure. The new mortgage fully pays off your old loan, allowing you to start with an updated agreement that better fits your financial needs.

Common Reasons Homeowners Choose to Refinance

Homeowners refinance for many practical reasons. Common motivations include lowering monthly payments, reducing long-term interest, switching from an adjustable rate to a fixed rate, or tapping into home equity for major expenses. Refinancing can also help remove mortgage insurance or shorten the loan term for faster payoff.

How Does Refinancing Work? A Step-by-Step Breakdown

The refinancing process follows several important steps that help lenders confirm your financial readiness. Each stage gives your lender updated information about your income, credit, assets, and home value. When all steps are completed, your new mortgage replaces the old one and begins with updated terms that match your financial goals.

Step 1: Review Your Finances and Credit Score

Start the refinancing process by checking your credit, income stability, and current debts. A healthy credit score helps secure better rates and improved options. Reviewing your finances early prepares you for a smooth application and reduces the chances of delays during underwriting.

Step 2: Compare Lenders and Get Rate Quotes

It is always smart to compare multiple lenders before choosing one. Different lenders offer unique pricing, closing costs, and loan options. Requesting rate quotes gives you a clear idea of available terms and helps you choose the offer that best fits your refinancing goals.

Step 3: Submit Your Application and Documents

Once you select a Mortgage lender, you will complete a loan application and submit your documents. These typically include pay stubs, bank statements, tax returns, and identification. Lenders use this information to confirm your income, assets, and debt levels before approving the refinance.

Step 4: Lock Your Rate and Complete the Appraisal

When your application is reviewed, you can lock your interest rate to protect it from market changes. The lender will then order a home appraisal to confirm your property’s value. This step helps determine your equity and ensures the new loan aligns with current market conditions.

Step 5: Final Underwriting and Closing Your New Loan

During final underwriting, the lender verifies your documents and reviews any new information. Once everything is approved, you will receive the closing documents to sign. After closing, your old mortgage is paid off, and your new loan begins with updated terms and payments.

Types of Mortgage Refinancing Options

Homeowners can choose from several refinancing options based on their financial goals. Each type serves a different purpose and offers unique benefits. Understanding these choices helps you select the refinance strategy that best supports your monthly budget, long-term plans, or equity needs.

Rate-and-Term Refinance

A rate-and-term refinance replaces your current mortgage with a new loan featuring improved terms. Homeowners use this option to shorten their loan term, secure a lower interest rate, or reduce their monthly payment. It is one of the most common refinancing choices.

Cash-Out Refinance

A cash-out refinance lets you borrow more than your current loan balance and receive the difference in cash. Homeowners often use the funds for renovations, debt consolidation, education, or investments. This option works best when you have strong equity in your home.

Cash-In Refinance

A cash-in refinance allows you to bring extra money to closing to reduce your loan balance. This option helps improve your loan-to-value ratio and may qualify you for better interest rates. It also helps remove mortgage insurance on some loan types.

Streamline Refinance for FHA and VA Loans

FHA and VA borrowers may qualify for a streamline refinance. These programs require less documentation and no full appraisal in many cases. They are designed to provide faster approval with reduced paperwork and easier qualification.

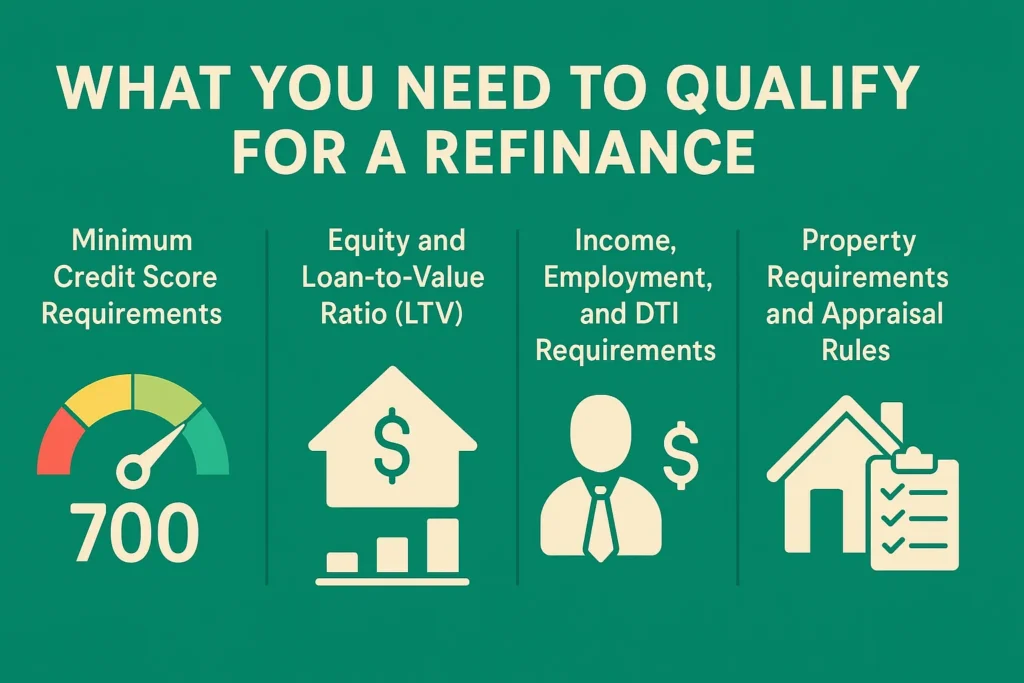

What You Need to Qualify for a Refinance

Refinancing requires meeting specific credit, income, and property guidelines. Lenders review your financial profile to confirm you can manage the new mortgage. Understanding these requirements helps you prepare early and prevents delays during the approval process.

Minimum Credit Score Requirements

Lenders typically require a strong credit score to offer competitive refinance terms. Conventional loans often need higher scores, while FHA loans provide more flexibility. Higher credit scores usually lead to better rates and lower long-term costs.

Equity and Loan-to-Value Ratio (LTV)

Your home’s equity affects your ability to refinance. Most lenders require a specific loan-to-value ratio to approve the loan. More equity can improve your rate options and help you qualify for cash-out programs or stronger loan terms.

Income, Employment, and DTI Requirements

Stable income and employment are essential for refinance approval. Lenders check your debt-to-income ratio to confirm you can manage monthly payments. Lower DTI levels offer better approval outcomes and more favorable loan options.

Property Requirements and Appraisal Rules

The home must meet certain property standards to qualify for refinancing. Lenders review appraisal results to confirm the property’s condition and value. The appraisal also helps determine your equity and ensures the loan amount reflects current market conditions.

Costs Involved in Mortgage Refinancing

Refinancing includes several costs that help lenders process the new loan and complete required services. Understanding these fees helps you plan your budget and decide whether refinancing is financially beneficial.

Typical Closing Costs for a Refinance

Most refinance closing costs range between two and five percent of the loan amount. These charges often include lender fees, title services, appraisal costs, and prepaid items. Each fee supports an important part of the refinance process and helps verify your home’s value and financial readiness.

How Lender Credits and Points Affect Costs

Borrowers can adjust upfront costs through lender credits or discount points. Lender credits reduce closing costs but increase your interest rate. Discount points lower your interest rate by paying more at closing. Understanding both options helps you choose the structure that supports your long-term goals.

No-Cost Refinance: Is It Really Free?

A no-cost refinance removes upfront fees by adding the costs to your loan balance or raising your interest rate. You avoid paying out of pocket, but long-term interest may increase. This option works best for borrowers who plan to move or refinance again within a shorter timeframe.

Pros and Cons of Refinancing

Refinancing offers valuable benefits, but homeowners should also consider potential drawbacks. Reviewing both sides helps you understand how refinancing affects long-term costs and monthly affordability.

| Category | Details |

|---|---|

| Key Benefits for Homeowners | Refinancing can lower monthly payments, reduce your interest rate, or shorten your loan term. It may also help remove mortgage insurance or access equity for major expenses. These advantages support long-term financial strength. |

| Potential Drawbacks to Consider | Refinancing may increase your loan balance or extend your repayment period. You may also pay closing fees and additional interest over time. Reviewing your financial goals helps determine whether refinancing is the right choice. |

How to Calculate Your Refinance Savings

Understanding your potential savings helps you decide whether refinancing is worth pursuing. Comparing monthly payments, closing costs, and long-term interest helps you make a confident and informed financial choice.

Estimating Monthly Payment Changes

Your new monthly payment depends on the interest rate, loan term, and final loan amount. Lower rates reduce monthly payments, while longer terms lower them further. Reviewing payment differences helps you see how refinancing improves monthly affordability.

Understanding the Break-Even Point

The break-even point shows how long it takes to recover your closing costs through monthly savings. Dividing total closing costs by monthly savings gives you the approximate timeline. Refinancing is usually beneficial when you plan to stay in the home long enough to pass this point.

Tools and Calculators You Can Use

Homeowners can use refinance calculators to estimate monthly savings, compare rates, and find their break-even point. These tools help simplify complex numbers and give you a clear understanding of how refinancing affects your budget.

Conclusion

Refinancing can be a valuable financial tool when used at the right time. It allows homeowners to lower monthly payments, secure better interest rates, or access home equity for important goals. By understanding the process, reviewing loan options, and preparing your financial profile, you can make informed decisions that support your long-term plans. Careful evaluation helps ensure that refinancing strengthens both your budget and your future financial stability.

FAQs

The best time to refinance is when interest rates are lower than your current rate or when improving your loan terms supports your long-term goals. A strong credit score and stable income also improve your results.

Not always. You can choose a shorter or similar loan term. Many homeowners refinance into a 20-year or 15-year loan to save more on long-term interest.

A refinance includes a hard credit check, which may cause a small, temporary drop. Your score usually stabilizes quickly, especially when you maintain strong financial habits.

Most lenders prefer at least twenty percent equity for the best terms. Some programs offer more flexibility, especially for streamline refinancing or loans backed by government programs.