Knowing how to buy a house in 2026 is the best way to move from renting to owning while keeping your finances safe.

This guide uses current 2026 data and expert tips to ensure you make the best choice for your future without overspending.

Below is a clear, step-by-step path that will take you from saving your first dollar to turning the key in your new front door.

How to Buy a House

Step 1: Check Your Financial Health

Before you look at houses, you must look at your money. Lenders in 2026 want to see that you can handle a monthly payment even if the economy changes.

Know Your Credit Score

Your credit score is the most important number in this process. It tells banks how well you pay back borrowed money.

- 620 or higher: Usually the minimum for a conventional loan.

- 740 or higher: This score typically gets you the lowest interest rates.

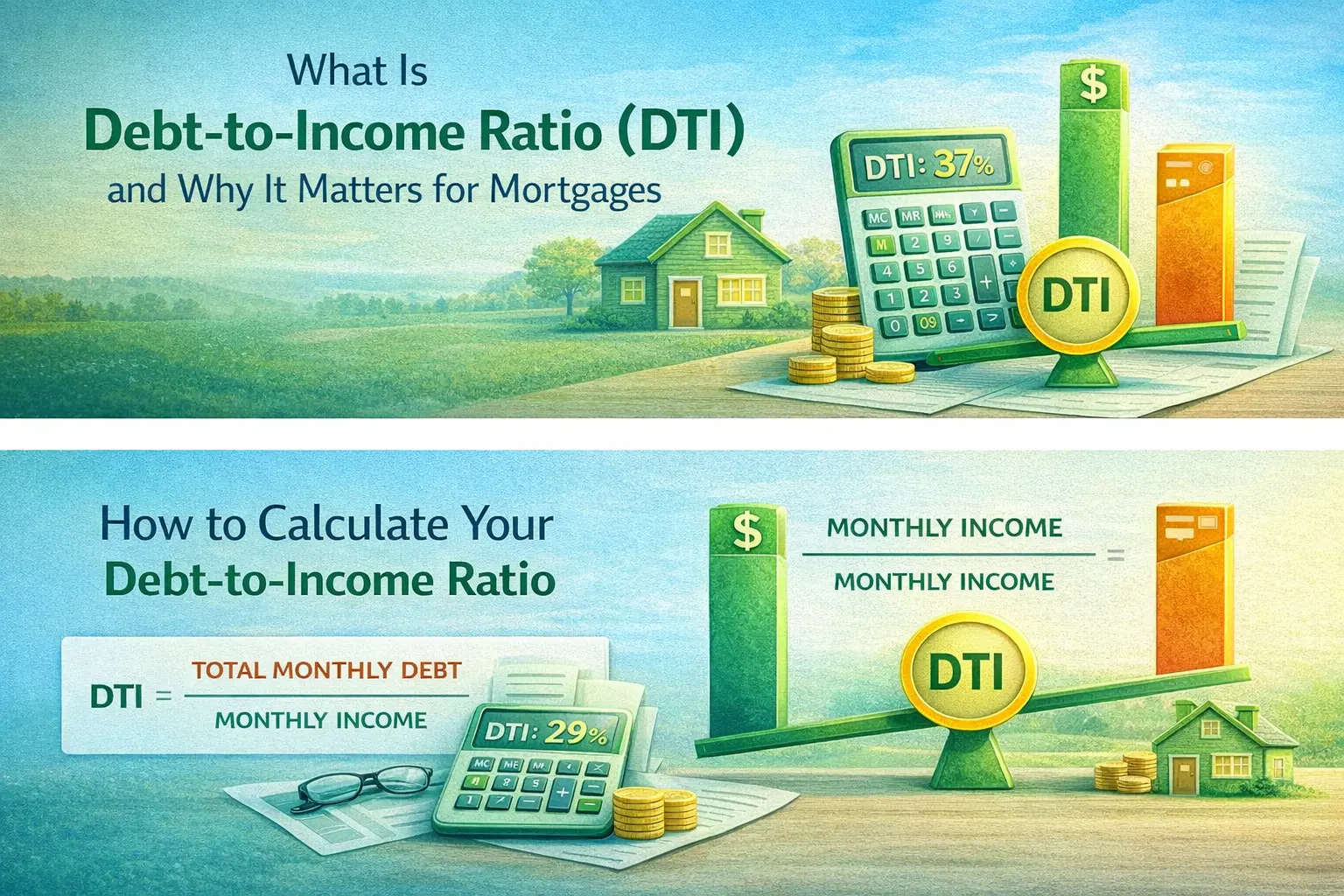

The 28/36 Rule

Most experts suggest the 28/36 rule. This means your house payment should be no more than 28% of your gross monthly income.

Also, your total debt (house + cars + cards) should be no more than 36%. You can find more about these ratios on official bank resource pages.

Step 2: Save for Your Down Payment and Closing Costs

A common myth is that you need 20% down. While 20% stops you from paying Private Mortgage Insurance (PMI), many people buy with much less.

Common Down Payment Amounts

| Loan Type | Minimum Down Payment | Best For |

| Conventional | 3% | Good credit buyers |

| FHA Loan | 3.5% | Lower credit scores |

| VA Loan | 0% | Veterans and Active Duty |

| USDA Loan | 0% | Rural area buyers |

Don’t Forget Closing Costs

Closing costs are the fees you pay to finish the deal. In 2026, these usually range from 2% to 5% of the home’s price. If you buy a $400,000 home, you might need $8,000 to $20,000 just for these fees.

Step 3: Get Pre-Approved for a Mortgage

A pre-approval letter is a document from a lender. It shows sellers that you are a serious buyer and that a bank has already checked your income.

In the balanced 2026 market, most sellers will not even look at your offer without this letter.

Don't lose your dream home to another buyer. Get a verified, 'market-ready' pre-approval from our team in under 24 hours.

Why Pre-Approval Matters

- It sets your budget so you do not fall in love with a house you cannot afford.

- It gives you more power to negotiate with the seller.

- It speeds up the final loan process once you find a home.

Step 4: Find a Real Estate Agent

A good agent is your partner. They find homes, set up tours, and handle the hard talk during negotiations. In 2026, agents also use AI tools to find “off-market” deals that are not yet on the big websites.

Best of all, as a buyer, you often do not pay your agent directly; their fee is usually covered by the seller.

Want an expert who knows your neighborhood inside and out? Connect with us to find off-market deals before they hit the big sites.

Step 5: Start House Hunting

Now for the fun part! Make a list of “Must-Haves” versus “Nice-to-Haves.”

- Must-Haves: Number of bedrooms, school district, or a home office.

- Nice-to-Haves: Granite counters, a pool, or a specific paint color.

Pro Tip: Look past the ugly carpet or old wallpaper. You can change those things. You cannot change the location or the size of the yard easily.

Step 6: Make an Offer and Negotiate

When you find the right home, your agent will help you write an offer. This includes the price you want to pay and “contingencies.”

Contingencies are rules that let you back out if something is wrong, like a bad inspection.

In 2026, the market will be more balanced. This means you might be able to ask the seller to pay for some of your closing costs or fix the roof before you move in.

Step 7: The Home Inspection and Appraisal

Once the seller says “yes,” the “under contract” phase begins.

- Inspection: A pro checks the house for bugs, leaks, or broken wires. If they find big problems, you can ask for a lower price.

- Appraisal: The bank sends someone to make sure the house is actually worth the price you are paying. They do this to protect their investment.

Step 8: Closing the Deal

Closing is the final step where you sign a lot of papers. You will pay your down payment and closing costs. The lender will do one final check of your credit. Do not buy a new car or open a new credit card during this time, or you might lose your loan!

Conclusion: Your Path to Homeownership

Learning how to buy a house is a journey that requires patience and a good plan. By checking your credit early, saving for both your down payment and closing costs, and getting a solid pre-approval, you put yourself ahead of other buyers.

The 2026 market offers a great balance for those who are prepared. Remember to lean on your agent and lender for help, and soon you will be moving into a place of your own.

Read More How to Refinance an FHA Loan to VA Loan

Frequently Asked Questions

How long does it take to buy a house?

From the time you find a house, it usually takes 30 to 45 days to close. However, the search for the right home can take weeks or months.

What is the 2026 average mortgage rate?

While rates change daily, many experts see 2026 rates staying between 6% and 6.5% for a 30-year fixed loan.

Can I buy a house with a 580 credit score?

Yes. An FHA loan often allows a score as low as 580 with a 3.5% down payment. However, your interest rate will be higher than someone with a 700 score.

What are “points” in a mortgage?

Points are fees you pay at the start to “buy down” your interest rate. One point usually costs 1% of your loan amount.