Buying your first home is exciting. But small mistakes can cost you a lot of money.

Many first-time buyers rush the process. Others miss important steps. The good news? You can avoid these problems with the right knowledge.

Let’s look at the most common mistakes and how to avoid them.

Why Avoiding Mistakes Matters

A home is a big financial decision. Mistakes can lead to:

- Higher monthly payments

- Loan rejection

- Extra fees

- Stress during closing

Smart planning saves money and keeps the process smooth.

First-Time Homebuyer Mistakes to Avoid

Mistake #1: Not Checking Your Credit Early

Your credit score affects:

- Loan approval

- Interest rate

- Down payment options

Many buyers wait too long to check their credit.

What to Do Instead:

- Check your credit at least 3–6 months before buying

- Fix errors on your credit report

- Pay down credit card balances

Want to know where your credit stands for a mortgage?

Our team can review your situation and explain your options.

Mistake #2: Skipping Mortgage Pre-Approval

Some buyers start house hunting without knowing their budget. This leads to disappointment or delays.

What to Do Instead:

- Get pre-approved before shopping

- Learn your true price range

- Show sellers you are serious

Pre-approval makes your offer stronger.

Ready to see how much home you can qualify for?

We can help you get pre-approved quickly and easily.

Mistake #3: Spending All Your Savings on the Down Payment

Buying a home costs more than just the down payment.

You also need money for:

- Closing costs

- Moving expenses

- Repairs

- Emergency savings

What to Do Instead:

- Keep some savings after closing

- Ask your lender about low down payment options

- Plan for future home expenses

Mistake #4: Ignoring Loan Options

Some buyers think there is only one type of mortgage. That’s not true.

There are many programs:

- FHA loans (great for first-time buyers)

- VA loans (for veterans and service members)

- USDA loans (for eligible rural areas)

- Conventional loans

What to Do Instead:

- Compare different loan types

- Ask about programs that fit your credit and income

Not sure which loan is right for you?

Our mortgage specialists can help match you with the best option.

Mistake #5: Making Big Financial Changes Before Closing

Lenders check your finances again before final approval. Big changes can cause problems.

Avoid:

- Opening new credit cards

- Buying a car

- Changing jobs suddenly

- Missing payments

What to Do Instead:

- Keep your finances stable

- Wait until after closing for big purchases

Mistake #6: Not Budgeting for All Homeownership Costs

Your mortgage is not your only expense. You must also plan for:

- Property taxes

- Home insurance

- Maintenance and repairs

- HOA fees (if applicable)

What to Do Instead:

- Ask for a full monthly payment estimate

- Set aside money for home maintenance

Mistake #7: Letting Emotions Control the Decision

Buying a home is emotional, but it is also a financial decision.

Some buyers:

- Overpay in bidding wars

- Ignore inspection issues

- Rush into homes they can’t afford

What to Do Instead:

- Stick to your budget

- Don’t skip the home inspection

- Think long-term, not just short-term feelings

Mistake #8: Not Asking Questions

Many first-time buyers feel shy about asking questions. This can lead to confusion later.

What to Do Instead:

- Ask your lender to explain fees

- Understand your loan terms

- Make sure you know your monthly payment

There are no “bad” questions when buying a home.

Smart Steps for First-Time Buyers

To stay on track:

- Check your credit early

- Get pre-approved

- Compare loan options

- Keep savings for emergencies

- Avoid new debt before closing

- Understand your full monthly costs

Planning ahead makes the process smoother.

Buying your first home soon?

Our experts are here to guide you from pre-approval to closing with clear, simple advice.

FAQs

What is the biggest mistake first-time homebuyers make?

Not getting pre-approved before house hunting is one of the most common mistakes.

How much money should I save before buying a house?

You should save for the down payment, closing costs, and extra money for emergencies and repairs.

Can I buy a house with bad credit as a first-time buyer?

Yes, FHA loans may allow lower credit scores, but interest rates may be higher.

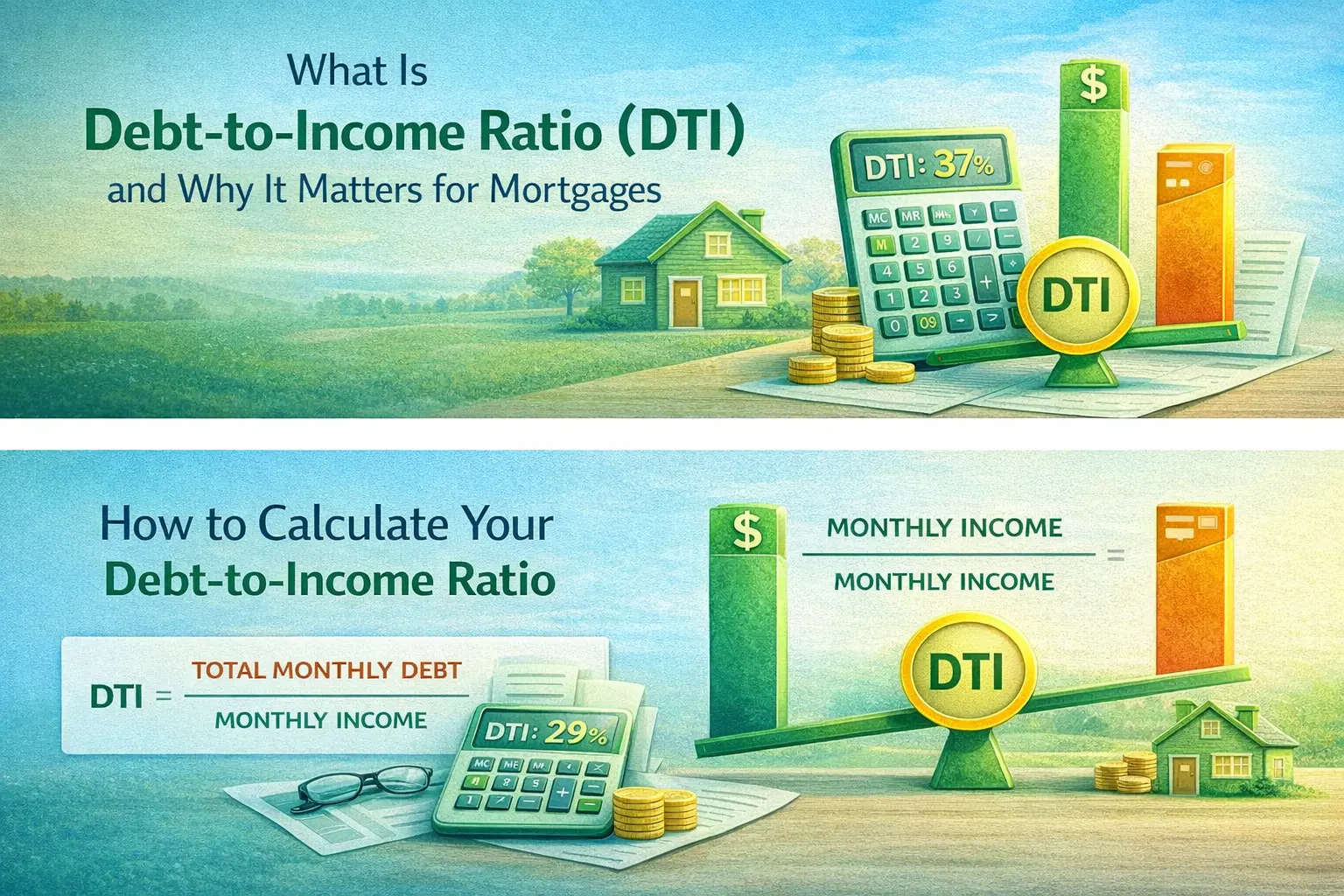

Should I pay off all my debt before buying a home?

Lower debt helps you qualify for a better loan, but you do not always need to be debt-free.

Why is mortgage pre-approval important?

Pre-approval shows sellers you are serious and tells you how much home you can afford.

What costs do first-time buyers forget about?

Many forget about property taxes, insurance, maintenance, and closing costs.

Can I change jobs while buying a house?

Job changes can affect loan approval, so it’s best to wait until after closing if possible.