Mortgage rates play a major role in determining how affordable your home loan will be. Understanding how these rates are set helps you plan your budget, estimate long-term costs, and make confident decisions as a homebuyer. When you know why rates move and how lenders calculate them, you can choose the right moment to move forward and secure a loan that aligns with your financial goals.

What Are Mortgage Rates and Why Do They Matter?

Mortgage rates represent the cost of borrowing money for your home purchase. These rates influence your payment size and the total interest you pay over the life of your loan. Even a small change in your rate can significantly affect affordability, which is why understanding how they work is essential for every homebuyer.

How mortgage rates affect monthly payments and long-term costs

Mortgage rates determine how much interest you pay each month on your loan. Higher rates increase monthly payments and raise the total interest paid over time. Lower rates reduce your payment and long-term cost, allowing you to build equity faster. Because the impact is so significant, comparing rate options can help you choose the most affordable path.

Why lenders adjust rates based on market conditions

Lenders monitor economic trends before adjusting mortgage rates. They track inflation, bond yields, and Federal Reserve decisions to manage risk and stay competitive. When economic conditions shift, lenders update their rates to match market expectations and protect against changing costs. This connection explains why mortgage rates move throughout the year and why timing matters when applying.

Key Factors That Determine Mortgage Rates

Mortgage rates change based on economic signals, market activity, and lender-specific considerations. Each factor influences how much it costs to borrow money, which is why understanding them helps you plan more confidently as a homebuyer.

Federal Reserve Policy and Economic Conditions

The Federal Reserve influences mortgage rates by adjusting its benchmark rate. When the Fed raises or lowers this rate, lenders respond by adjusting pricing to match new borrowing costs.

How inflation and economic growth affect rates

-

High inflation usually leads to higher mortgage rates

-

Slow economic growth may cause rates to fall

-

Strong job markets and rising wages often push rates upward

Lenders track these factors to manage risk and set competitive rates.

Bond Market and Treasury Yields

Mortgage rates often move alongside the 10-year Treasury yield. When bond yields rise, lenders increase mortgage rates to maintain returns that match investor expectations.

Market reactions to economic news

-

Economic reports can trigger sudden rate changes

-

Positive financial news may cause rates to rise

-

Market uncertainty often leads to lower yields and rates

These shifts explain daily mortgage rate fluctuations.

Lender Costs, Competition, and Market Demand

Lenders consider staffing, technology, compliance, and loan processing expenses when setting rates. Higher operating costs can lead to higher interest rates.

How lender competition influences rate offers

-

Competitive markets may result in lower rates

-

Local lenders often adjust pricing to attract buyers

-

High demand can push rates upward temporarily

Rates vary between lenders based on strategy and market conditions.

Mortgage Type and Loan Term

Fixed-rate mortgages offer stable payments, while adjustable-rate mortgages start with lower rates that may increase later. Lenders price these options differently due to risk levels.

15-year vs 30-year rate differences

-

Shorter terms usually have lower rates

-

Longer terms cost more because the lender carries risk longer

-

A 15-year loan builds equity faster with less total interest

Your chosen loan type shapes your rate.

Government-Backed vs Conventional Loan Rates

Government-backed loans often provide lower rates because they reduce lender risk. FHA, VA, and USDA loans come with protections that allow more flexible pricing.

Risk differences and pricing adjustments

-

Conventional loans depend heavily on credit strength

-

Low down payments can increase rates

-

Loan limits and program guidelines affect pricing

Different loan types offer unique benefits based on borrower needs.

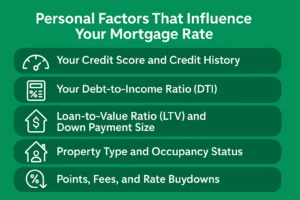

Personal Factors That Influence Your Mortgage Rate

Your financial profile directly affects the rate lenders offer you. By improving certain areas—such as credit, income stability, and down payment size you may qualify for lower and more favorable mortgage pricing.

Your Credit Score and Credit History

Higher credit scores lead to better mortgage rates. A strong payment history and responsible credit use show lenders that you are a lower-risk borrower.

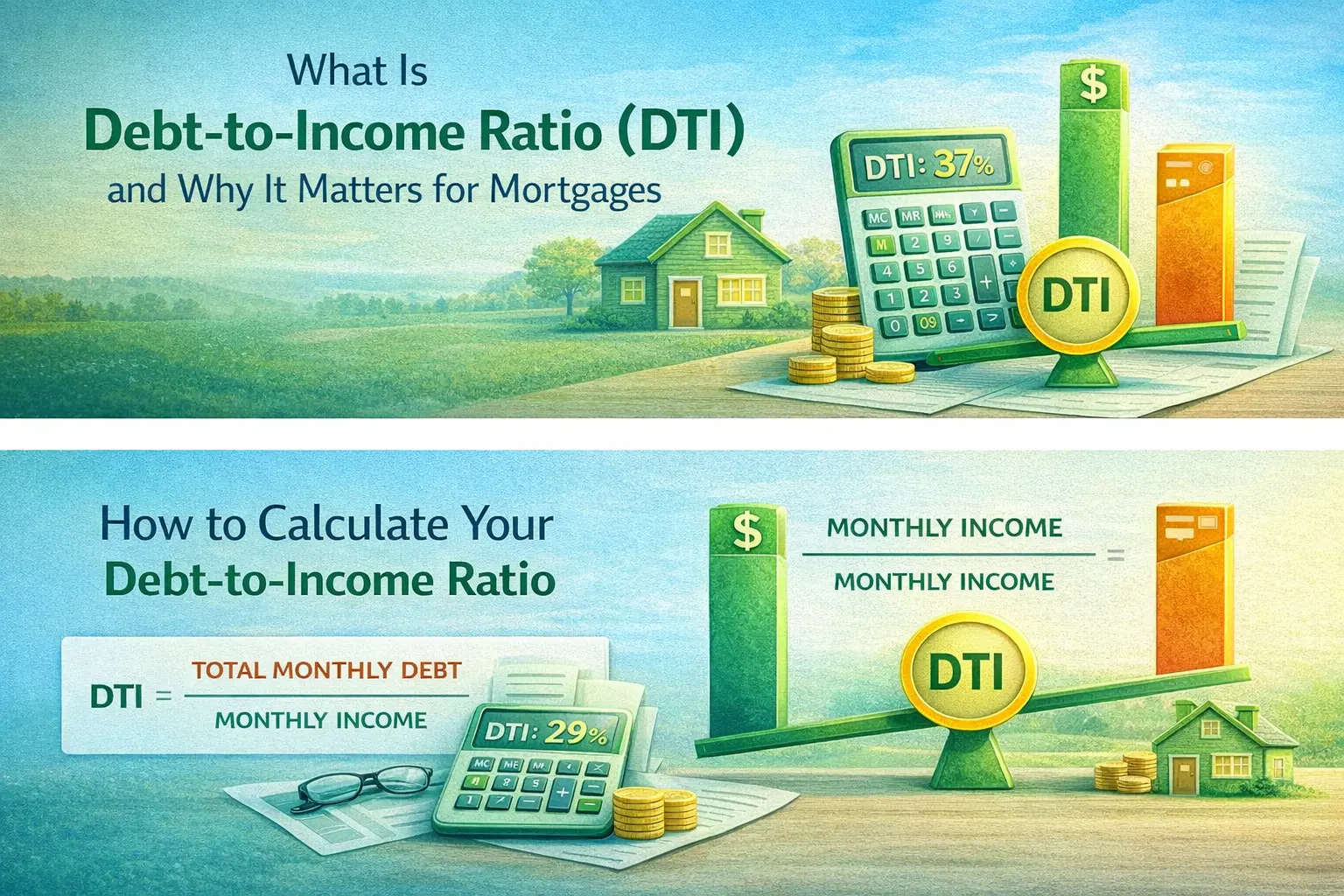

Your Debt-to-Income Ratio (DTI)

DTI measures how much of your income goes toward debt. Lower ratios help you qualify for better rates because they show you can manage monthly payments comfortably.

Loan-to-Value Ratio (LTV) and Down Payment Size

A larger down payment lowers your LTV and reduces lender risk. Borrowers with lower LTV ratios often receive better interest rates.

Property Type and Occupancy Status

-

Primary residences offer the best rate options

-

Second homes usually come with slightly higher rates

-

Investment properties have the highest rates due to added risk

Lenders adjust pricing based on how the property will be used.

Points, Fees, and Rate Buydowns

Borrowers can reduce their rate by paying discount points upfront. Lenders also adjust rates based on closing costs, origination fees, and buydown options chosen by the borrower.

How Daily Rate Changes Work

Mortgage rates can shift from one day to the next based on market activity. These changes reflect investor sentiment, economic conditions, and lender updates. Understanding this volatility helps you track rates more effectively and choose the right time to apply.

Why Rates Change Throughout the Week

Rates do not stay fixed during the week because lenders react to shifting market signals. Several factors influence these changes:

-

Daily economic news

-

Market reactions to financial reports

-

Investor activity and bond market movement

This is why you may see different rate quotes even a day apart.

How Lenders Update Rate Sheets Each Day

Lenders review market data every morning before releasing updated rate sheets. They consider:

-

Overnight bond yield changes

-

Federal Reserve statements

-

Market pricing for mortgage-backed securities

If the market moves sharply during the day, lenders may issue multiple rate updates to stay aligned with current conditions.

External Events That Can Trigger Sudden Rate Movement

Mortgage rates can shift quickly when unexpected events occur. Common triggers include:

-

Economic reports, such as jobs data or inflation numbers

-

Federal Reserve announcements

-

Geopolitical events that affect global markets

These events create uncertainty, which often leads to rapid rate adjustments.

How Homebuyers Can Monitor and Predict Rate Trends

Tracking mortgage rate trends helps you make informed decisions. By using reliable tools and understanding economic signals, you can better time your application and secure a competitive rate.

Using Mortgage Rate Indexes and Market Trackers

Homebuyers can follow mortgage rate trends using public tools such as:

-

Mortgage-backed securities (MBS) trackers

-

Treasury yield charts

-

National mortgage rate indexes

These resources give a clear view of daily movement.

Understanding Mortgage News and Economic Calendars

Economic calendars highlight key data releases that influence rates. Important reports include:

-

Jobs reports

-

Inflation readings

-

Consumer spending data

Monitoring these updates helps you anticipate possible rate changes.

When It Makes Sense to Lock Your Rate

Rate locks protect you from future increases. It usually makes sense to lock in when:

-

Rates are stable or trending upward

-

You are close to submitting final documents

-

Economic reports are expected to push rates higher

A well-timed lock can save you money over the life of your loan.

Expert Tips to Secure the Lowest Possible Rate

Securing a low mortgage rate requires preparation and smart financial choices. Small improvements in your profile can lead to meaningful long-term savings.

Improve Your Credit Before Applying

Higher credit scores qualify for better rates. You can strengthen your score by:

-

Paying bills on time

-

Reducing credit card balances

-

Avoiding new credit inquiries before applying

These steps demonstrate reliable financial behavior.

Compare Multiple Lenders and Loan Options

Rates vary between lenders, even on the same day. You can increase your chances of finding a low rate by:

-

Requesting several loan estimates

-

Comparing fees and terms

-

Reviewing lender programs that fit your needs

Shopping smart helps you avoid overpaying.

Consider Shorter Loan Terms When Possible

Shorter terms, like a 15-year loan, usually come with lower interest rates. They offer:

-

Less total interest paid

-

Faster equity growth

-

Lower long-term borrowing costs

However, they also come with higher monthly payments.

Use Discount Points Strategically

Discount points allow you to lower your interest rate by paying upfront. This strategy works best when:

-

You plan to stay in the home long enough to break even

-

You prefer long-term payment stability

-

You want to reduce interest costs over the life of your loan

Carefully reviewing costs helps you decide if points add value.

Conclusion

Understanding how mortgage rates are determined helps you make smarter decisions during your homebuying journey. Rates are shaped by economic trends, bond markets, lender considerations, and your personal financial profile. When you know how these factors work together, you can choose the right loan, time your application well, and secure a more affordable rate. By staying informed and preparing early, you position yourself for a smoother and more confident homebuying experience.

FAQs

What causes mortgage rates to change?

Mortgage rates move based on economic reports, inflation trends, Federal Reserve decisions, and bond market performance. Lenders adjust pricing daily to match market conditions.

How much does my credit score impact my mortgage rate?

Your credit score plays a major role. Higher scores qualify for better rates because they show consistent payment behavior. Lower scores may result in higher pricing.

Do different loan types have different mortgage rates?

Yes. Fixed, adjustable, FHA, VA, USDA, and conventional loans all have unique pricing structures. Each program carries different levels of lender risk.

When is the best time to lock my mortgage rate?

It’s often smart to lock when rates are stable or rising. Locking before major economic announcements can also protect you from sudden increases.