Buying a home with bad credit feels challenging, but many buyers still reach approval with the right strategy. Several loan programs support lower credit scores, and lenders often review your entire financial picture before making a decision. When you understand how credit affects your options, you can prepare confidently and choose a loan that supports your path to homeownership.

What Bad Credit Means for Homebuyers

Bad credit can limit your loan options, but it does not stop you from buying a home. Lenders review your score to understand risk and determine which loan programs fit your situation. When you know how credit influences rates, terms, and approval, you can plan and improve your chances of success.

How Credit Scores Affect Loan Options and Rates

Your credit score helps lenders understand how you handle financial obligations. Higher scores give you better interest rates and more loan choices. Lower scores lead to higher rates because lenders want stronger protection. You can still qualify with bad credit when you show stable income, savings, and good payment habits.

Minimum Scores Needed for FHA, VA, USDA, and Conventional Loans

Different loan programs use different score requirements.

Typical guidelines include:

- FHA loans: Often work with scores starting at 580

- VA loans: No set minimum, but lenders prefer 580–620

- USDA loans: Many lenders want 620 or higher

- Conventional loans: Usually require 620 or higher

These programs give buyers with weaker credit several paths to approval.

What Lenders Look For Beyond Your Credit Score

Lenders review your full financial profile, not just your score. They check your income stability, savings history, debt levels, and overall financial habits. You can improve your approval odds by showing consistent income and responsible money management. Lenders also want to see a realistic budget that supports long-term affordability.

Best Home Loan Programs for Buyers With Bad Credit

Buyers with bad credit still have several loan programs that support flexible approval guidelines. Each program uses unique rules and benefits, so understanding these options helps you choose the loan that fits your situation. When you match the right loan to your financial profile, you increase your chances of becoming a homeowner.

FHA Loans: Flexible Requirements for Lower Scores

FHA loans offer one of the most accessible paths for buyers with bad credit. You can qualify with a lower score because FHA insurance reduces lender risk. Many buyers choose FHA loans because they support smaller down payments and easier approval requirements. This option works well when you want a clear and affordable starting point.

VA Loans: Strong Benefits for Qualified Veterans

VA loans support eligible veterans, service members, and qualified spouses with powerful benefits. These loans do not require a down payment and often include lower interest rates. You also avoid mortgage insurance, which reduces long-term costs. VA loans work well when you qualify through service history and want strong financial advantages.

USDA Loans: No Down Payment for Eligible Areas

USDA loans help buyers purchase homes in approved rural areas. These loans offer no down payment options and lower rates for qualified buyers. Many lenders prefer a score of 620 or higher, but some use flexible guidelines. USDA loans are a good option if you want affordable payments and live in an eligible area.

Non-QM and Alternative Mortgage Options

Non-QM loans help buyers who cannot qualify through standard mortgage rules. These programs support unique income situations, including self-employed borrowers and buyers recovering from financial challenges. They offer flexible approval terms but often include higher rates. Non-QM loans work well when traditional programs do not match your financial profile.

How to Improve Your Approval Odds With Bad Credit

You can increase your approval chances when you strengthen key parts of your financial profile. Lenders want to see responsible habits, consistent income, and a clear plan for managing your mortgage. Small improvements create big differences when you apply for a loan with bad credit.

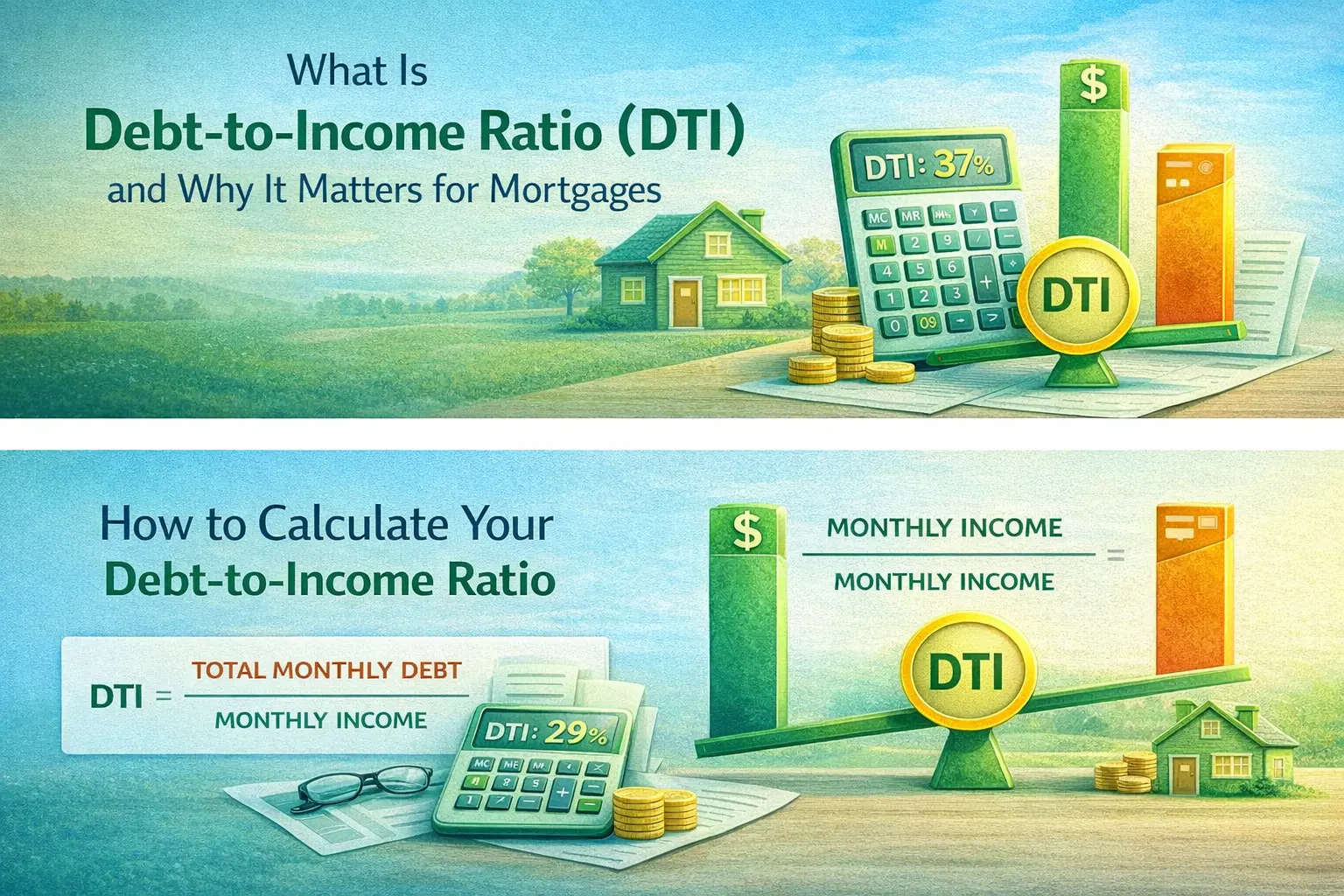

Lowering Your DTI and Strengthening Your Financial Profile

Lowering your debt-to-income ratio shows you can manage new payments comfortably. You can improve your DTI by paying down revolving balances and avoiding new debts. A lower DTI gives lenders more confidence in your ability to handle mortgage payments. This habit strengthens your overall financial picture.

Building a Larger Down Payment for Better Terms

A larger down payment helps you qualify even with lower credit. You reduce your loan amount and give lenders more security. Saving early creates better loan options and improves your long-term costs. Many buyers aim for at least five to ten percent when credit needs improvement.

Using a Co-Signer or Co-Borrower to Boost Approval

A co-signer or co-borrower with stronger credit helps you qualify for loans that would otherwise feel out of reach. This person shares responsibility for the mortgage and supports your financial application. You gain access to better rates and stronger loan programs when you use this option responsibly.

Showing Strong Income Stability and Savings History

Lenders want to see steady income, consistent employment, and a clear savings pattern. These signs show that you manage your finances well, even with lower credit. You also build trust when you show months of reserves in your savings account. This stability helps you secure approval more easily.

Step-by-Step Guide: How to Buy a Home With Bad Credit

You can buy a home with bad credit when you follow clear steps and prepare early. Each step helps you understand your financial position, choose the right loan, and protect your long-term goals. A focused plan gives you confidence and improves your chances of approval.

Step 1: Check Your Credit and Fix Errors Quickly

Start by reviewing your credit reports from all major bureaus. Correct any errors that hurt your score and dispute inaccurate accounts. You can raise your score quickly when you fix these issues early. This step helps you start the process with a clean foundation.

Step 2: Get Pre-Approved With a Lender Who Works With Low Scores

Choose a lender who specializes in helping buyers with lower credit. These lenders understand flexible loan programs and know how to guide your application. A pre-approval shows your buying power and gives you a clear price range. You can also uncover possible issues before you start shopping.

Step 3: Explore Loan Programs That Fit Your Situation

Review loan options that support lower credit scores, including FHA, VA, USDA, and certain non-QM programs. Each program includes unique benefits and requirements. You can compare these choices to find the one that matches your goals. Understanding your options helps you choose a realistic path.

Step 4: Compare Interest Rates, Fees, and Loan Requirements

Interest rates and fees vary widely between lenders. Compare total costs, not just the rate, to see the true value of each loan. You can ask lenders for clear loan estimates to help you decide. Careful comparison saves you money and prevents long-term stress.

Step 5: Choose a Home That Fits Your Budget and Approval Range

Select a home that matches your pre-approval amount and long-term financial comfort. You want monthly payments that feel manageable based on your income and goals. A realistic choice helps you avoid financial pressure and increases lender confidence. This approach supports a smooth closing process.

Tips to Improve Your Credit Before Applying

You can strengthen your credit quickly when you focus on smart financial habits. Many buyers increase their scores within weeks or months. These tips help you prepare for a mortgage and improve your loan options.

Paying Down Revolving Debt for Quick Score Gains

Paying down credit card balances creates some of the fastest score improvements. Lower utilization shows that you manage credit responsibly. You gain more points when your balances stay under thirty percent of your limit. This progress increases your approval odds.

Avoiding New Credit Accounts Before Your Loan

New credit inquiries can lower your score and concern lenders. Avoid applying for new cards or loans while preparing for a mortgage. This habit keeps your score stable and clean. Lenders prefer a quiet and steady credit history.

Using Credit-Building Tools to Strengthen Your Profile

Credit-building tools, such as secured cards or credit-builder loans, help you show positive payment history. These tools support slow and steady growth. You also improve your profile when you track your credit regularly. Consistent effort creates meaningful progress.

Conclusion

You can buy a home with bad credit when you follow a clear plan and choose the right loan program. Strong preparation, steady financial habits, and early lender guidance help you overcome credit challenges. When you improve key areas like your DTI, savings, and payment history, you strengthen your approval chances. With the right steps, you can move toward homeownership confidently and choose a mortgage that supports your long-term goals.

FAQs

Yes, you can qualify with a score under 600 through programs like FHA or certain non-QM loans. You improve your chances when you show stable income and consistent financial habits.

Many buyers aim for at least five to ten percent to strengthen their applications. A larger down payment reduces lender risk and improves your loan options.

Yes, stronger credit helps you secure lower rates and more flexible terms. Even small score increases create meaningful savings over the life of your mortgage.

Yes, lenders who specialize in low-credit buyers understand flexible loan programs and approval strategies. Their guidance helps you find programs that fit your financial situation.