If you plan to buy a home, getting pre-approved is your first smart step.

Pre-approval shows sellers you are serious. It tells you exactly how much home you can afford. It also makes your offer stronger in competitive markets.

Let’s break it down simply.

What Does Mortgage Pre-Approval Mean?

Mortgage pre-approval means a lender reviews:

- Your income

- Your credit score

- Your debts

- Your financial documents

Then they give you a written letter stating how much they are willing to lend.

This is stronger than pre-qualification.

Why Pre-Approval Matters

Getting pre-approved helps you:

- Know your real budget

- Avoid looking at homes you can’t afford

- Move faster when you find the right house

- Show sellers you are financially ready

In many U.S. markets, sellers prefer buyers with a pre-approval letter.

Want to buy with confidence? Get pre-approved for a mortgage and know exactly how much home you can afford.

Step-by-Step: How to Get Pre-Approved for a Mortgage

Step 1: Check Your Credit Score

Your credit score affects:

- Loan approval

- Interest rate

- Monthly payment

Most loan programs require:

- 620+ for conventional loans

- 580+ for FHA loans

- 620+ for most VA loans

Higher score = better rate.

Step 2: Gather Your Documents

Lenders usually ask for:

- Last 2 pay stubs

- Last 2 years of W-2s or tax returns

- Bank statements (last 2 months)

- Photo ID

- Social Security number

If self-employed, you may need additional tax documents.

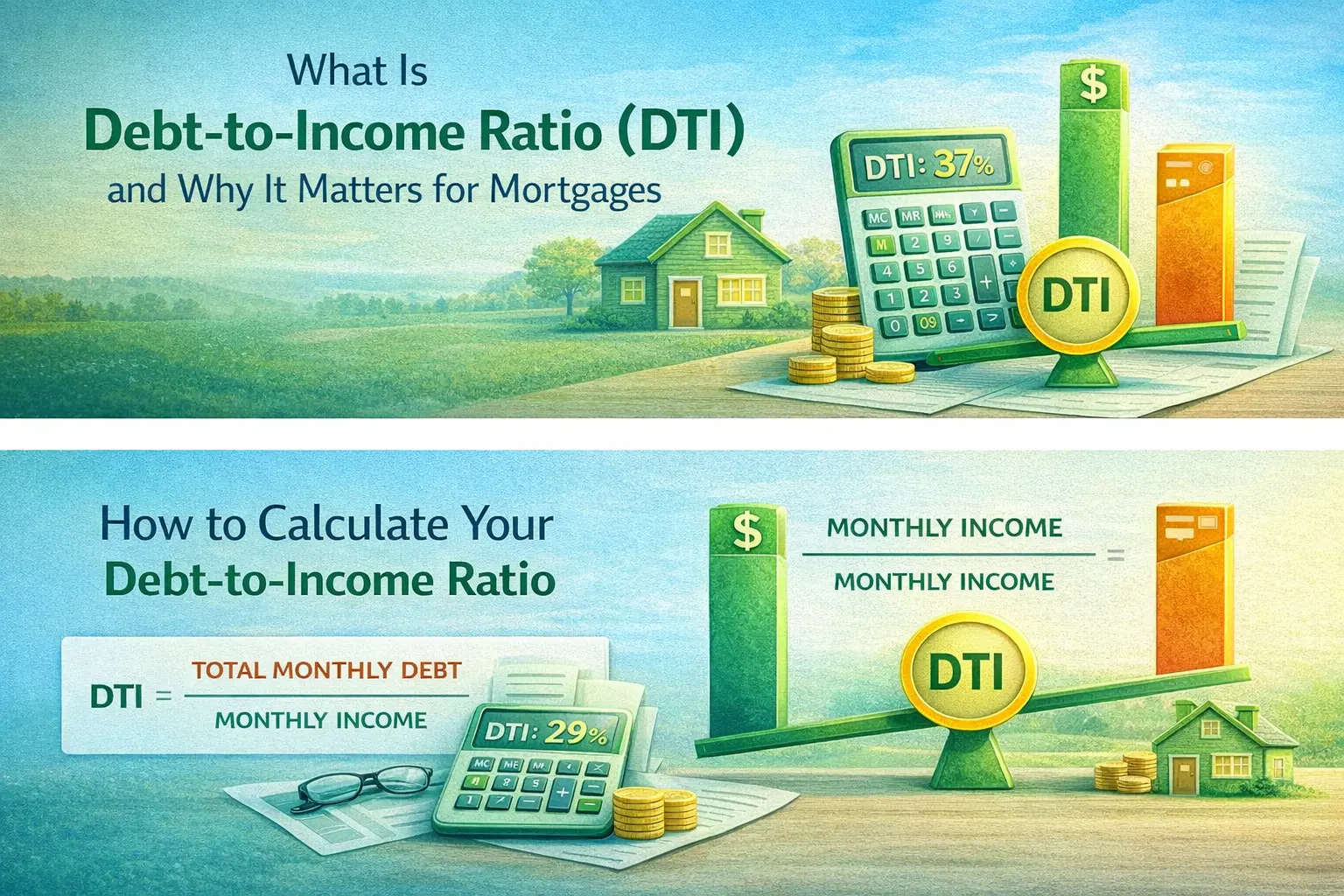

Step 3: Calculate Your Debt-to-Income Ratio (DTI)

DTI compares your monthly debts to your income.

Lenders usually prefer:

- 36% or lower (ideal)

- Up to 43% for many programs

Lower DTI improves approval chances.

Step 4: Choose the Right Loan Program

Different loans have different requirements:

- FHA loans – lower credit flexibility

- Conventional loans – good for strong credit

- VA loans – for eligible veterans

- USDA loans – for eligible rural areas

Choosing the right program increases your approval odds.

Step 5: Submit Your Application

You can apply:

- Online

- Over the phone

- In person

The lender runs a credit check and reviews your documents.

If approved, you receive a pre-approval letter.

How Long Does Mortgage Pre-Approval Take?

Most pre-approvals take:

- 24–72 hours

- Sometimes same-day with complete documents

Delays usually happen when documents are missing.

How Long Is a Pre-Approval Good For?

Most pre-approval letters are valid for:

- 60 to 90 days

After that, lenders may re-check your credit and income.

What Can Hurt Your Pre-Approval?

Avoid these mistakes after getting pre-approved:

- Do not open new credit cards

- Do not finance a car

- Do not miss payments

- Do not change jobs suddenly

Big financial changes can cancel your approval.

Pre-Approval vs Pre-Qualification

| Pre-Qualification | Pre-Approval |

| Estimate only | Verified review |

| No document check | Income & credit verified |

| Weaker offer | Stronger offer |

Pre-approval carries more weight.

What Happens After Pre-Approval?

Once pre-approved:

- Start house hunting

- Make an offer

- Move into full loan underwriting

- Schedule appraisal

- Close on your home

Pre-approval is step one, not final approval.

Key Takeaways

- Pre-approval verifies your finances

- It strengthens your offer

- It helps you shop with confidence

- It speeds up the buying process

If you’re serious about buying, pre-approval is not optional, it’s essential.

Ready to Get Pre-Approved?

Want to know exactly how much you qualify for?

Our team can review your income, credit, and loan options to give you a fast and accurate pre-approval, so you can shop with confidence.

FAQs

How do I get pre-approved for a mortgage?

Submit your income, credit, and financial documents to a lender. They review everything and issue a pre-approval letter.

Does pre-approval hurt your credit score?

It may cause a small temporary drop due to a hard inquiry, but it usually has minimal impact.

How much does mortgage pre-approval cost?

Many lenders offer pre-approval for free.

How long does mortgage pre-approval take?

Usually 1–3 business days, sometimes faster.

Can I get denied after pre-approval?

Yes, if your financial situation changes or new issues appear during underwriting.

Is pre-approval required to make an offer?

In most U.S. markets, sellers expect it before accepting an offer.