Finding the key factors to consider when buying a home in 2026 is the best way to make a smart choice that protects your money and your family.

This guide uses new 2026 data to show you exactly what to look for so you can feel confident when you find “the one.”

Below is a list of the ten most important things to check before you decide to buy your next house.

Key Factors to Consider When Buying a Home

1. Mortgage Rates and Your Monthly Payment

In 2026, experts from Realtor.com say mortgage rates are averaging around 6.3%. This number is very important because even a tiny change can make your monthly payment much higher or lower.

- Monthly Costs: Always look at the total price, including house insurance and property taxes.

- Buying Power: If rates go down, you can afford a more expensive house. If they go up, you might need to look at cheaper homes.

- Long-Term Plan: Ask your bank if you can “refinance” later if rates drop even more.

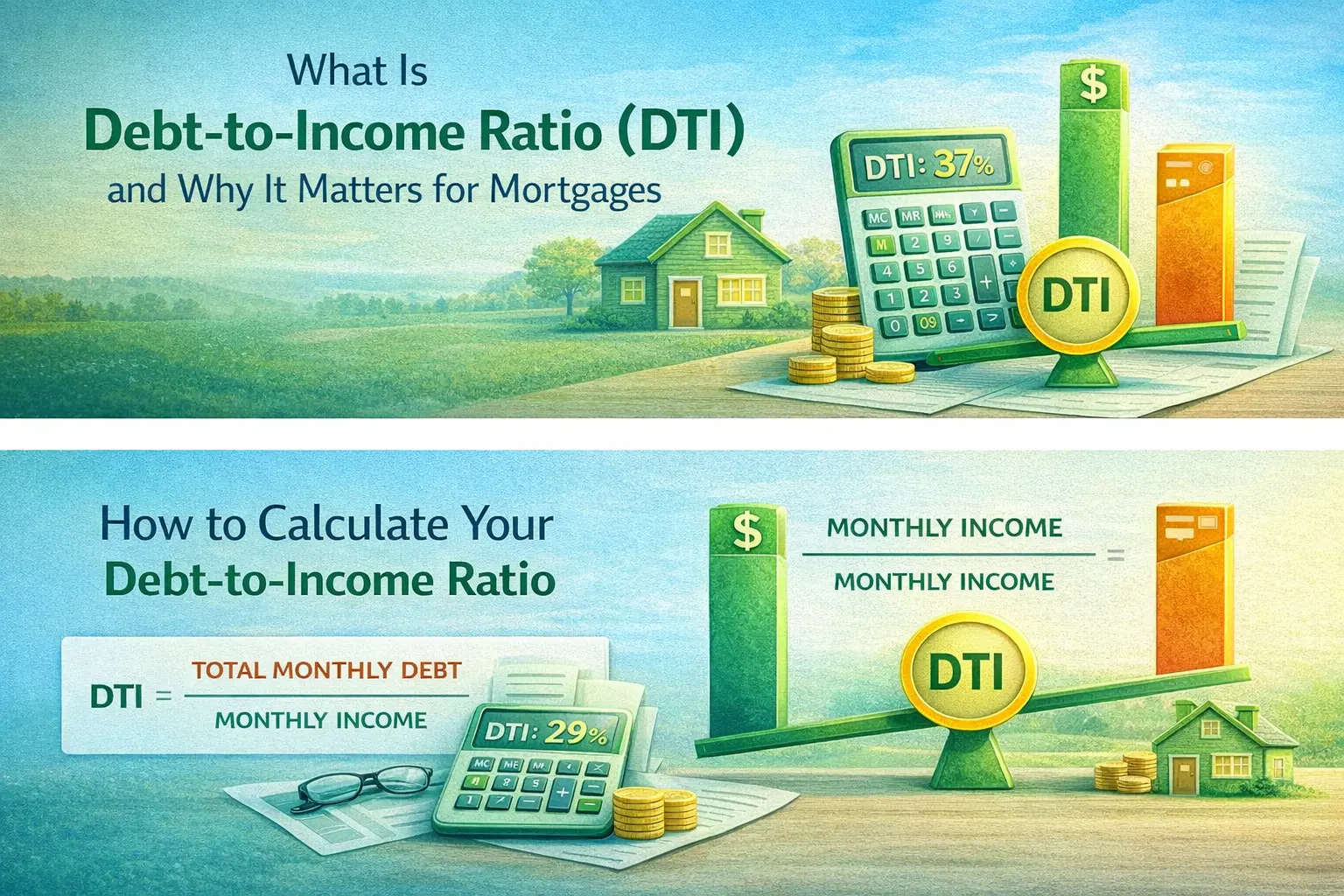

2. Your Debt-to-Income (DTI) Ratio

Lenders use a math rule called DTI to see if you can afford a loan. They compare how much you earn to how much you owe on cars, credit cards, and student loans.

- The 43% Rule: Most banks want your total debt to be less than 43% of your monthly pay.

- The Sweet Spot: Staying below 36% usually helps you get the best interest rates.

- New 2026 Rules: Banks are looking closer at “hidden” debts like “Buy Now, Pay Later” plans, so be careful with those.

3. Location and Your Daily Life

You can change the paint in a house, but you cannot move where it sits. The location is the most important of all key factors to consider when buying a home.

- Work Commute: Drive from the house to your job during rush hour to see how it feels.

- Local Shops: Check how far it is to the grocery store, the doctor, and the gym.

- Noise Level: Visit the house on a weekend and a weekday to check for loud traffic or planes.

4. The Quality of Local Schools

Even if you do not have kids, living near a good school is a smart move. Homes in top school districts usually sell for 10% to 20% more than other homes.

- Resale Value: A house near a high-rated school is much easier to sell later.

- Safe Growth: These areas usually stay valuable even when the economy is slow.

- Tax Money: Better schools often mean the neighborhood is well-funded and clean.

5. Home Condition and Inspection Reports

Every house has secrets. A home inspection is a pro’s way of finding them before you buy.

- The Big Three: Always check the roof, the foundation, and the plumbing.

- Repair Costs: If a roof is 20 years old, you might need to spend $15,000 soon to fix it.

- Seller Fixes: If the inspector finds a problem, you can ask the seller to fix it or lower the price.

Worried about hidden repairs? Work with an agent who knows how to spot red flags before you even book an inspection.

6. Future Growth and Home Size

Think about what your life will look like in five years. A house that is perfect today might be too small tomorrow.

- Extra Rooms: An extra bedroom can work as an office or a place for a new baby.

- The Yard: If you have pets or want a garden, make sure the yard is big enough.

- Flex Space: Look for basements or attics that you can finish later to add value.

7. Property Taxes and HOA Fees

The “sticker price” of the home is just the start. You also have to pay the city and maybe a neighborhood group.

- Tax Changes: Property taxes can go up every year. Ask what the current owner pays.

- HOA Rules: Some Homeowners Associations (HOA) have strict rules about paint colors or where you park your car.

- Monthly Fees: An HOA fee can add $200 or more to your monthly bill. Make sure it is worth it.

8. Energy Efficiency and Utility Bills

In 2026, energy costs are high. An energy-efficient home can save you a lot of money every month.

- Better Windows: Double-pane windows keep the heat inside during winter.

- Smart Tools: Things like smart thermostats can lower your electric bill by 10%.

- Solar Power: Many homes now have solar panels which can almost erase your power bill.

9. Resale Potential

Unless this is your “forever home,” you will likely sell it one day. You want a house that other people will want to buy.

- Common Features: Houses with 3 bedrooms and 2 bathrooms are usually the easiest to sell.

- Neighborhood Trends: Is the area getting better? Look for new parks or shops being built nearby.

- Market Speed: Ask your agent how many days homes stay for sale in that area.

10. Maintenance and Upkeep Costs

Owning a home is a lot of work. You should plan to save about 1% of your home’s value every year just for repairs.

- Landscaping: A big yard looks great but takes time and money to mow and water.

- Old vs. New: New homes usually need fewer repairs for the first 10 years.

- Emergency Fund: Always keep a little extra cash for when the water heater breaks.

Comparing Old vs. New Homes

| Feature | Older Home (Charm) | New Home (Modern) |

| Price | Usually cheaper to buy | Usually costs more |

| Repairs | Needs more work soon | Very few repairs needed |

| Efficiency | Higher energy bills | Lower energy bills |

| Location | Established trees/parks | Newer, smaller trees |

Conclusion:

Focusing on these key factors to consider when buying a home will help you avoid big mistakes. Buying a home is a marathon, not a sprint. Do not feel rushed by the market or other buyers.

If you check the location, the schools, and the home’s condition, you will find a place that is a perfect fit for your life and your wallet.

Frequently Asked Questions

What is the most important factor?

Affordability is the most important factor. You should never buy a house that leaves you with no money for food or fun.

How much cash do I need for a down payment?

While 20% is great, many people buy with only 3% to 3.5% down. Veterans can often buy with 0% down.

Should I buy a house that needs work?

Only if you have the extra money and time to fix it. “Fixer-uppers” can be stressful if you are living in them while repairing.

How long does the buying process take?

Once you find a house, it usually takes about 30 to 45 days to finish the paperwork and move in.