Knowing the requirements to buy a house for the first-time in 2026 is the best way to stop renting and start owning your own home.

This guide uses 2026 data to show you exactly what banks are looking for so you can get an “Easy Yes” on your loan.

Below is the complete list of rules and steps you need to follow to make your dream of owning a home come true.

Requirements to Buy a House for the First-time in 2026

1. Credit Score Rules for New Buyers

Your credit score is a number that tells a bank if you are good at paying back money. In 2026, different loans have different rules for this number.

- FHA Loans: You usually need a score of 580.

- Conventional Loans: Most banks want to see a 620 or higher.

- VA and USDA Loans: These often look for a 640, but they can be more flexible.

2. Income and Job History

Banks want to know that you have a steady job so you can pay for the house every month.

- Two-Year Rule: Most lenders want to see that you have worked in the same field for at least two years.

- Proof of Pay: You will need to show your last 30 days of pay stubs and your last two years of W-2 forms.

- Self-Employed: If you work for yourself, you will need to show two years of tax returns.

3. Money Saved for a Down Payment

You do not always need 20% down. In fact, most first-time buyers in 2026 use special programs that require much less.

- 3% to 3.5%: This is the most common amount for new buyers.

- 0% Down: If you are a Veteran or buying in a rural area, you might not need any down payment at all.

- Gifts: You are allowed to use money given to you by a family member as a “gift” for your down payment.

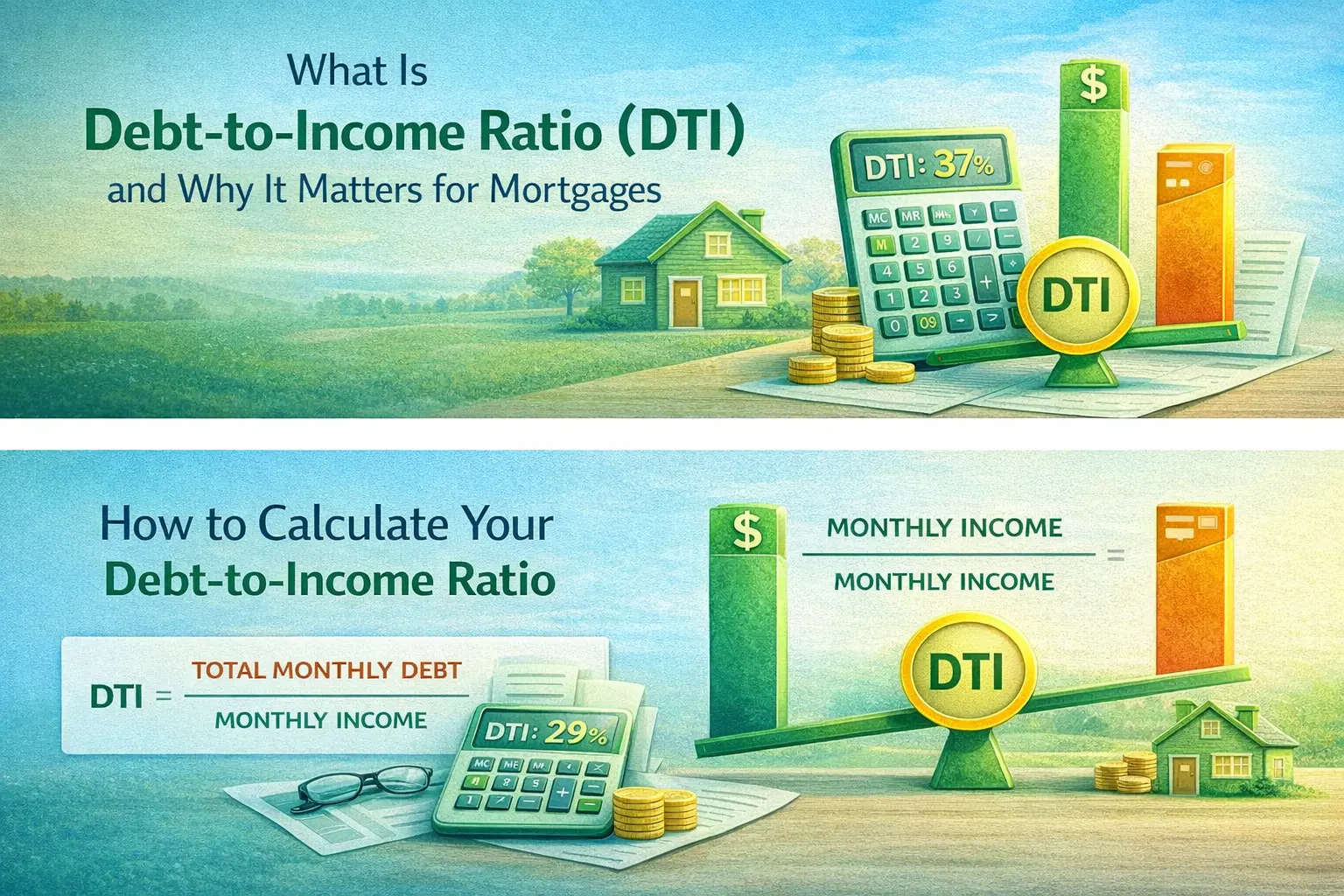

4. Debt-to-Income (DTI) Limits

Lenders check how much of your monthly pay goes to debts like car loans or credit cards. According to the Consumer Financial Protection Bureau, keeping your total debt below 43% of your pay is a key requirement.

5. The “Hidden” Requirements People Forget

To meet all the requirements to buy a house for the first-time, you need to know the small rules that banks sometimes hide in the fine print.

Sourced and Seasoned Funds

The bank needs to see where your money came from.

- The 60-Day Rule: Your down payment money should be in your bank account for at least two months before you apply.

- No Large Cash Deposits: If you suddenly put $5,000 in cash into your account, the bank will ask where it came from. They want to make sure it is not a secret loan.

Homebuyer Education Classes

In 2026, many low-down-payment loans require you to take a short class.

- Online Learning: These classes usually take 4 to 8 hours.

- The Benefit: Taking the class can sometimes help you get a lower interest rate or help with closing costs.

Cash Reserves

The bank does not want you to be "house poor" with zero dollars left.

- Safety Net: Some loans require you to have 1 or 2 months of mortgage payments still in your bank account after you buy the house.

6. Paperwork and Documents

To finish the requirements to buy a house for the first-time, you must have your paperwork ready.

- ID: A valid driver’s license or passport.

- Bank Statements: Your last two months of statements for every account.

- Tax Returns: Your last two years of federal tax filings.

2026 First-Time Buyer Requirements Summary

| Requirement | Minimum Needed | Why It Matters |

| Credit Score | 580 – 620 | Gets you a lower interest rate |

| Down Payment | 0% – 3.5% | The cash you pay upfront |

| Job History | 2 Years | Proves you have a steady income |

| Sourced Funds | 60 Days | Shows you didn’t take out a secret loan |

| Education | Online Class | Required for many 2026 grant programs |

Ready to buy a home without the hidden surprises? Our experts guide you through every secret rule so you can close on time.

Conclusion:

Meeting the requirements to buy a house for the first-time is just a matter of following a checklist. If you have a steady job, fair credit, and some savings, you are closer than you think. Take it one step at a time, and soon you will be holding the keys to your new home.

Read More 10 Key Factors to Consider When Buying a Home

Frequently Asked Questions

Can I buy a house if I have student loans?

Yes. As long as your total monthly debt fits within the bank’s rules, student loans will not stop you from buying a home.

What is the 2026 average mortgage rate?

Rates change daily, but in 2026, they have stayed between 6% and 6.5% for most buyers.

Do I need a perfect credit score?

No. Many programs help buyers with scores in the 600s get a great home.