Mortgage pre-approval is one of the most important steps in preparing to buy a home. It helps you understand your budget, strengthens your offer, and shows sellers you are a serious buyer. When you know what pre-approval involves and how lenders evaluate your finances, you can move through the homebuying process with more confidence and clarity.

What Mortgage Pre-Approval Really Means

Mortgage pre-approval is a lender’s written confirmation that you qualify for a specific loan amount based on your financial profile. It shows sellers that you are ready to buy and gives you a clear picture of how much you can afford. With a strong pre-approval in place, you enter the market prepared and financially verified.

Pre-Qualification vs Pre-Approval: Key Differences

Pre-qualification is an informal estimate of how much you may borrow based on basic financial details. Pre-approval is more detailed and requires verification of your documents, income, credit, and assets. Because it involves a deeper review, pre-approval carries more weight with sellers and real estate agents.

What Lenders Evaluate During Pre-Approval

Lenders look at several key factors when reviewing your pre-approval application, including:

-

Your credit score and full credit history

-

Income stability and employment verification

-

Debt-to-income ratio and monthly obligations

-

Bank statements, assets, and down payment sources

These details help lenders confirm your ability to manage future mortgage payments.

How Long a Pre-Approval Letter Lasts

Most pre-approval letters remain valid for 60 to 90 days. This timeframe allows lenders to rely on your financial information while also ensuring that your income, credit score, and debts remain current. If your letter expires, updating your documents usually makes renewal simple.

Mortgage Pre-Approval Requirements

Mortgage pre-approval requires a detailed review of your financial situation. Lenders examine your credit, income, assets, debts, and employment history to confirm you are ready for a mortgage. Meeting these requirements improves your chances of qualifying for a strong pre-approval letter.

Credit Score and Credit History Expectations

Lenders check your credit score to understand how you manage payments and credit accounts. Higher scores usually qualify for better rates and larger loan amounts. Late payments, collections, and recent credit issues can affect your approval strength and may require additional documentation.

Income, Employment, and Verification Documents

Stable income is essential for mortgage approval. Lenders verify your employment and review documents such as:

-

Recent pay stubs

-

W-2 forms

-

Tax returns

-

Bank statements

These details confirm that you can manage monthly mortgage payments over time.

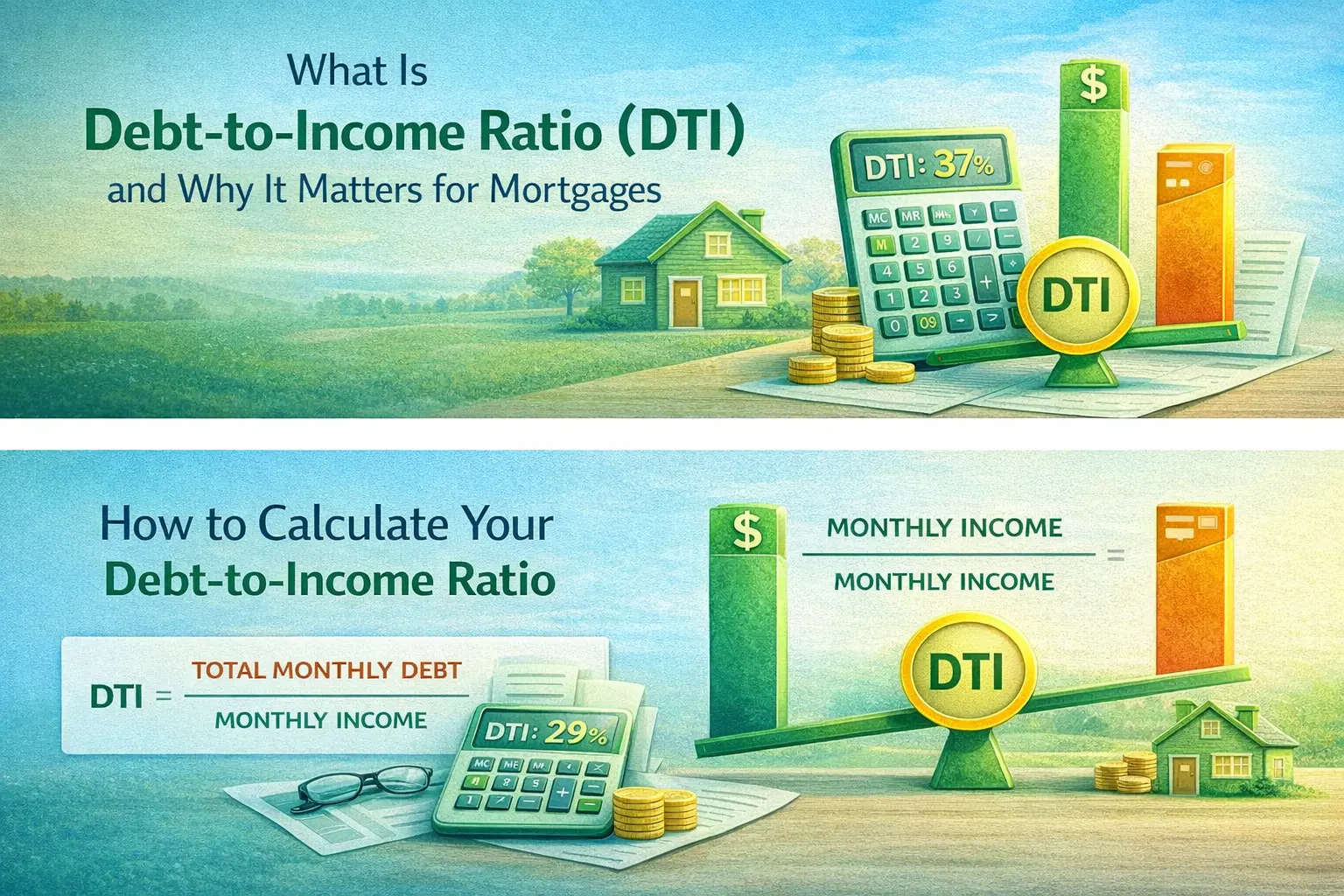

Debt-to-Income Ratio Limits (DTI)

Your debt-to-income ratio shows how much of your income goes toward monthly debt. Lower DTI levels improve your approval chances because they demonstrate strong financial stability. Higher ratios may limit your loan amount or delay pre-approval until debts are reduced.

Down Payment Source and Asset Verification

Lenders also verify where your down payment funds come from. They check your bank statements to confirm savings, gift funds, or other verified assets. Clear documentation helps prevent delays and ensures the funds meet program guidelines.

Additional Documentation for Self-Employed Borrowers

Self-employed borrowers must provide more detailed financial records. Lenders may request:

-

Two years of business and personal tax returns

-

Profit and loss statements

-

Business bank statements

-

Proof of ongoing business activity

These documents help verify income stability and business performance.

Step-By-Step: How the Pre-Approval Process Works

The pre-approval process involves several key steps that help lenders understand your financial picture. Completing these steps carefully improves your chances of receiving a strong pre-approval letter.

Step 1: Check Your Credit and Fix Any Issues

Start by reviewing your credit report to identify errors or outdated information. Paying down revolving balances and correcting mistakes can improve your score and strengthen your pre-approval.

Step 2: Gather All Required Financial Documents

Collect all requested documents before applying. Organizing your pay stubs, tax returns, bank statements, and ID ensures a smoother and faster pre-approval process.

Step 3: Compare Lenders and Submit Your Application

It is smart to compare multiple lenders to find the best terms. When you submit your application, each lender will review your financial information and pull your credit to begin the evaluation.

Step 4: Receive Your Pre-Approval Letter

After reviewing your details, the lender issues a pre-approval letter showing your maximum loan amount. This document helps you shop for homes confidently and signals to sellers that you are financially ready to proceed.

Step 5: Do’s and Don’ts After You’re Pre-Approved

Once you are pre-approved, avoid major financial changes. Do not open new accounts, take on new debt, or change jobs without speaking to your lender. Continue paying bills on time and keeping your financial profile stable until closing.

How Much You Can Afford: Key Factors Lenders Consider

Understanding how much you can afford helps you search for homes confidently. Lenders examine several financial details to determine a safe and realistic loan amount that fits your long-term budget.

Your Monthly Budget and Lifestyle Costs

Your mortgage payment should fit comfortably within your monthly budget. Lenders look at your income, spending habits, and recurring expenses. Balancing housing costs with daily living expenses helps you avoid financial stress after purchasing.

Loan Programs and How They Affect Approval Amount

Different loan programs influence how much you can borrow. FHA, VA, and conventional loans have unique guidelines and qualification limits. Your choice of program affects your required down payment, mortgage insurance, and overall loan amount.

Property Taxes, Insurance, and HOA Fees

Lenders include property taxes, homeowners insurance, and HOA fees when determining your affordability. These costs can change based on the location and type of property. Understanding them helps you plan for true monthly housing expenses.

Common Reasons Pre-Approval Gets Denied

Pre-approval denial can happen when financial details do not meet program requirements. Knowing the common issues helps you prepare and address concerns before applying for a mortgage.

High Debt Levels or Low Income

High debt or limited income can affect your debt-to-income ratio. When DTI is too high, lenders may not approve the loan because it shows a limited ability to manage new payments.

Unstable Employment or Recent Job Changes

Lenders prefer steady employment. Large gaps in work history or recent major job changes may cause delays or denials, especially if income cannot be verified consistently.

Credit Score Drops After Application

A sudden drop in your credit score can impact your approval. New debt, missed payments, or high credit use may signal financial instability and lead to reconsideration.

Undocumented or Unverified Funds

Lenders must confirm your down payment sources and assets. If funds cannot be verified or documented, pre-approval may be denied until the details are clarified and properly supported.

Tips to Improve Your Chances of Getting Pre-Approved

Preparing early can strengthen your financial profile and increase your likelihood of getting approved. Small improvements can make a meaningful difference in your loan options.

Strengthen Your Credit Before Applying

Paying bills on time, reducing credit card balances, and correcting credit report errors help improve your score. A higher score often leads to stronger loan terms.

Lower Your DTI by Paying Down Debts

Reducing your monthly debt obligations increases your borrowing capacity. Paying off credit cards or small loans helps improve your debt-to-income ratio.

Increase Savings for a Stronger Down Payment

A larger down payment shows financial stability and reduces your loan-to-value ratio. More savings can improve approval odds and lower your long-term mortgage costs.

Avoid New Debt and Large Purchases

New debt can increase your DTI and lower your score. Avoid major purchases such as cars, furniture, or new credit lines until your loan closes.

Work With a Trusted Mortgage Lender Early

Early guidance helps you understand requirements, identify potential issues, and prepare stronger documentation. Working with an experienced lender streamlines the pre-approval process.

How Pre-Approval Helps You Win in a Competitive Market

A strong pre-approval gives you a major advantage when searching for a home. It shows sellers that you are serious, financially ready, and able to move forward quickly during negotiations.

Makes Your Offer More Credible to Sellers

Sellers prefer buyers who already have lender verification. A pre-approval letter shows you can afford the home and reduces uncertainty during the offer process.

Speeds Up the Closing Process

Pre-approval speeds up underwriting because much of your financial review is already completed. This helps you move faster when you find the right home.

Helps You Avoid Homes Outside Your Budget

Pre-approval gives you a clear price range. This helps you focus on homes you can afford and prevents wasted time on properties that do not fit your financial limits.

Conclusion

Mortgage pre-approval gives you the confidence and clarity you need when entering the homebuying process. It shows you how much you can afford, strengthens your offer, and prepares you for competitive markets. With organized documents, strong credit, and steady finances, you can move through pre-approval smoothly and avoid unexpected delays. Taking these steps early helps you shop with confidence and stay ready when the right home appears.

FAQs

How long does it take to get mortgage pre-approved?

Most lenders can issue a pre-approval within 24 to 72 hours once all documents are provided. Complex situations may take longer if extra verification is needed.

Does pre-approval guarantee final loan approval?

No. Pre-approval is a strong indicator but not a guarantee. Final approval depends on underwriting, property conditions, and stable financial information through closing.

Will multiple pre-approval applications hurt my credit score?

Rate shopping within a short window usually counts as one inquiry. Most scoring models allow multiple mortgage checks within 14 to 45 days without major impact.

What happens if my financial situation changes after pre-approval?

Major changes such as new debt, job changes, or lower credit scores—may affect your loan amount or require a new review. It is best to maintain financial stability.