An FHA loan is a popular mortgage option designed to help more buyers qualify for homeownership. It offers flexible credit requirements, low down payment options, and easier approval standards. Because FHA loans are insured by the Federal Housing Administration, lenders can offer more accessible terms. Understanding how FHA loans work helps you decide whether this program aligns with your homebuying goals.

What Is an FHA Loan?

An FHA loan is a government-backed mortgage designed to support buyers who need flexible credit and down payment options. The Federal Housing Administration insures the loan, which reduces risk for lenders and makes qualification easier. FHA loans are widely used by first-time buyers and those who want an affordable path to purchasing a home.

How FHA Insurance Works

FHA insurance protects lenders if a borrower cannot repay the loan. This insurance reduces lending risk and encourages lenders to approve more applications with lower credit scores or smaller down payments. Borrowers pay an upfront and annual mortgage insurance premium, which supports the program and keeps FHA loans accessible.

Typical FHA Loan Uses

FHA loans can be used to purchase a variety of property types that meet FHA guidelines. Buyers often use them for single-family homes, approved condos, and certain manufactured homes. These options give homeowners flexibility while ensuring each property meets safety and livability standards set by the FHA.

FHA Loan Programs and Common Variants

FHA loans offer several program options that support different financial needs. Each program provides flexible terms and unique benefits, making it easier for buyers and homeowners to choose a loan that matches their goals. Understanding these options helps you select the right FHA loan for your situation.

203(b) Standard FHA Purchase Loan

The 203(b) program is the most common FHA loan used by homebuyers. It offers low down payments, flexible credit guidelines, and financing for primary residences. This loan is ideal for first-time buyers who need an affordable path to homeownership.

FHA Streamline Refinance (FHA-to-FHA)

The FHA Streamline Refinance helps current FHA borrowers lower their rate with reduced paperwork. Many borrowers do not need a full appraisal or extensive documentation. This program is designed to simplify refinancing and create faster approval times.

FHA Adjustable-Rate Mortgages (ARMs) and Other Options

FHA ARMs provide lower initial rates that adjust over time. These loans can help borrowers who plan to sell or refinance in the future. FHA also offers additional programs for specific needs, giving buyers several choices within the FHA system.

Key Eligibility Requirements for FHA Loans

FHA loans have clear guidelines that help lenders review your financial readiness. These requirements focus on your credit, income stability, and property selection. Preparing early improves your chances of receiving approval with favorable terms.

Credit Score and Down Payment Rules (580 vs 500 rules)

Borrowers with a 580 credit score or higher typically qualify for a 3.5 percent down payment. Those with scores between 500 and 579 may qualify with a ten percent down payment. These flexible rules help more buyers enter the housing market.

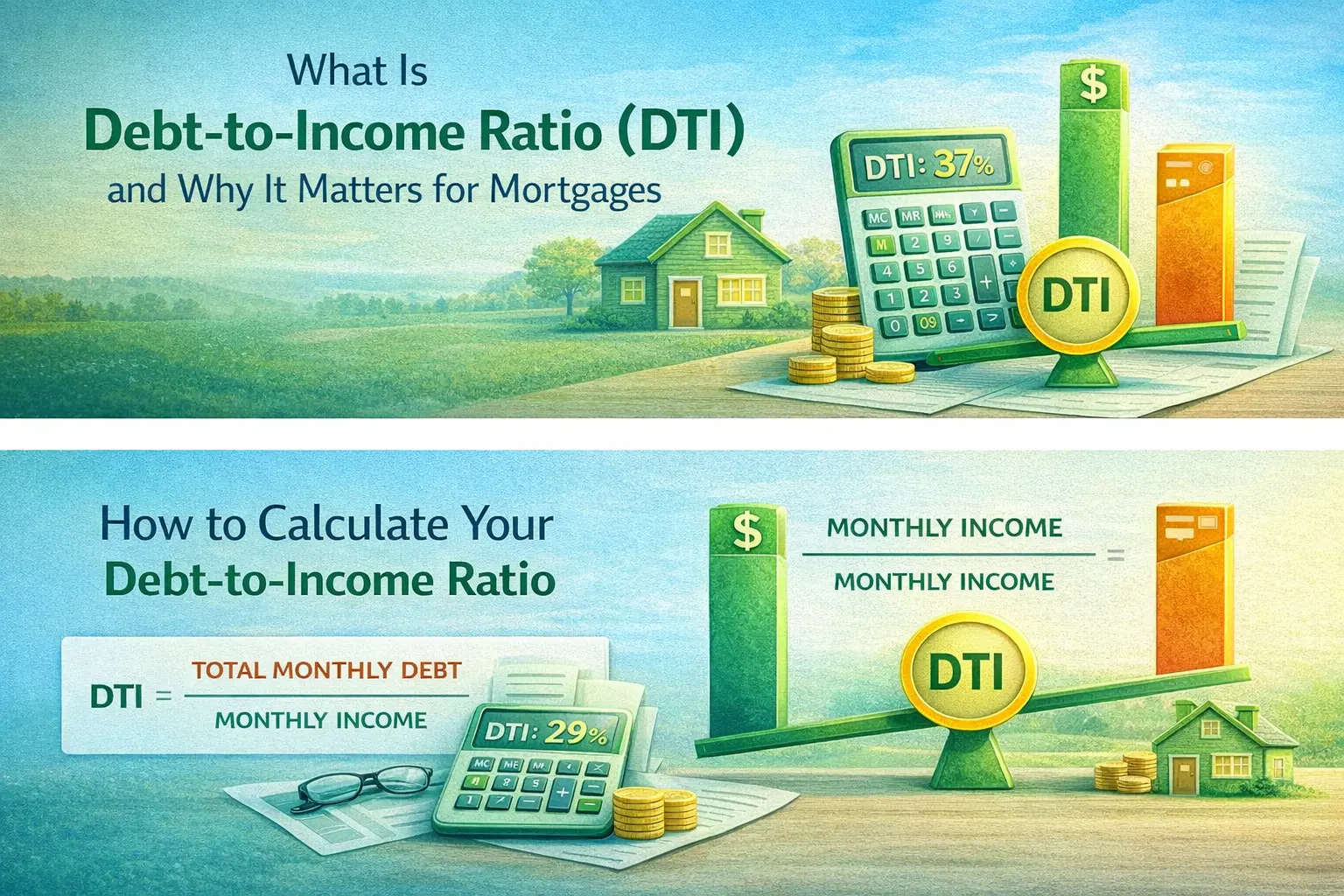

Income, Employment, and DTI Expectations

FHA lenders review your income stability, employment history, and debt-to-income ratio. Steady income and manageable monthly debt levels help lenders confirm you can afford the new mortgage. Lower DTI levels often result in stronger approval outcomes.

Property & Occupancy Rules (primary residence requirement)

FHA loans require the property to be your primary residence. The home must meet FHA safety and quality standards, confirmed through an FHA appraisal. These rules ensure the property is suitable for long-term occupancy and aligns with program goals.

Costs and Mortgage Insurance (MIP) Explained

FHA loans include mortgage insurance that protects lenders and keeps approval guidelines flexible. This insurance adds to your costs but also makes the program more accessible. Understanding MIP helps you budget accurately and compare loan options.

Up-Front Mortgage Insurance Premium (UFMIP)

FHA loans include an upfront mortgage insurance premium paid at closing. This amount is usually added to your loan balance. UFMIP supports the FHA program and allows lenders to offer more flexible qualification rules.

Annual Mortgage Insurance

Annual mortgage insurance is paid monthly and added to your mortgage payment. The amount depends on your loan term, loan amount, and down payment. This insurance continues for different lengths of time based on your loan-to-value ratio.

How Mortgage Insurance Can Be Removed or Avoided

Mortgage insurance on most FHA loans remains for the life of the loan when the down payment is less than ten percent. Borrowers who want to remove MIP often refinance into a conventional loan once they have enough equity. This strategy helps reduce long-term housing costs.

How the FHA Loan Process Works

The FHA loan process involves several steps that help your lender review your finances and confirm that the property meets FHA requirements. Understanding each stage prepares you for a smoother approval and helps you stay organized throughout your homebuying journey.

Pre-Qualification and Document Checklist

Pre-qualification helps estimate how much you may be able to borrow. Your lender will review your basic financial details and request supporting documents. Preparing these early helps speed up the application.

Common documents include:

- Recent pay stubs

- Bank statements

- W-2 forms and tax returns

- Government-issued identification

- Employment history details

Appraisal, Underwriting, and Approval

FHA loans require a specific appraisal to confirm property value and safety standards. Underwriting begins once the appraisal is complete. The underwriter reviews your credit, income, assets, and loan file before granting final approval. Clear documentation improves your chances of moving through underwriting quickly.

Closing and Post-Closing Requirements

During closing, you review and sign your final loan documents. Once the lender releases the funds, you receive the keys and complete the ownership transfer. After closing, you begin making your mortgage payments, including your FHA mortgage insurance premium.

Pros and Cons of an FHA Loan

FHA loans offer meaningful advantages for many buyers, but they also include long-term costs that borrowers should understand. Comparing both sides helps you decide whether an FHA mortgage is the right fit for your financial goals.

| Pros | Cons |

|---|---|

| Low down payment options | Mortgage insurance added to monthly payments |

| Flexible credit score requirements | MIP often lasts for the entire loan term |

| Easier qualification for buyers | Loan limits vary by county and may be restrictive |

| Competitive interest rates | Higher long-term costs compared to some conventional loans |

How to Apply for an FHA Loan

Applying for an FHA loan is straightforward when you understand the requirements and prepare your financial documents early. A strong application helps lenders review your file quickly and offer accurate loan options.

Credit fixes, down payment sources, and document tips

Improving your financial profile before applying strengthens your application. Consider these helpful steps:

- Review your credit report for errors

- Reduce credit card balances to improve your score

- Organize bank statements, pay stubs, and tax records

- Confirm down payment sources meet FHA guidelines

Working with FHA-approved lenders and agents

An FHA-approved lender guides you through the process and explains every program rule clearly. When you work with experienced professionals, you understand each requirement, compare loan options with confidence, and choose the path that supports your goals. Clear communication keeps your application moving smoothly from start to finish.

Conclusion

An FHA loan gives many buyers a strong path to homeownership. You get flexible credit guidelines, low down payment options, and predictable loan terms. When you understand the program, you can compare your options and choose the loan that supports your long-term plans. With the right preparation, you can move through the FHA process with confidence and reach your homebuying goals faster.

FAQs

Buyers with lower credit scores or limited savings often choose FHA loans because they offer easier qualification and low down payment options.

You can use an FHA loan for a primary residence that meets FHA safety and quality standards. The program does not allow second homes or investment properties.

You need at least 3.5 percent down with a 580 credit score. Scores between 500 and 579 require ten percent down.

You can remove FHA mortgage insurance only by refinancing into a conventional loan once you build enough equity.